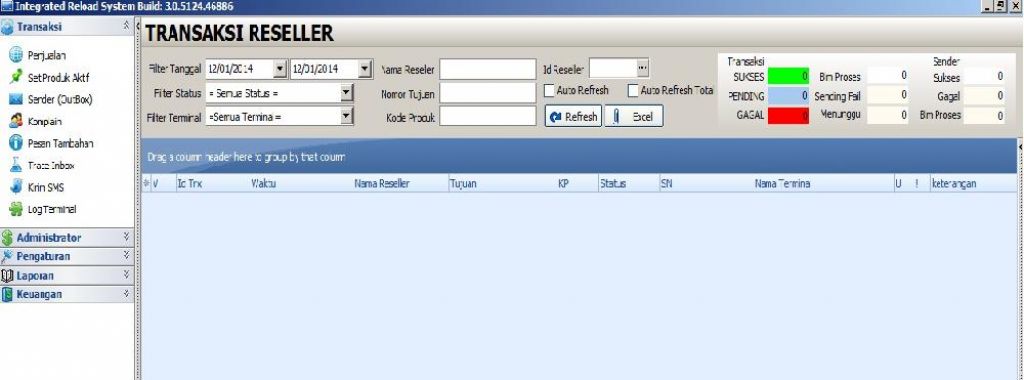

Software Pulsa Irs

Best listening experience is on Chrome, Firefox or Safari. Subscribe to Federal Drive’s daily audio interviews on. As lawmakers and tax policy experts look to revitalize the IRS Oversight Board that’s lain dormant for years, one proposal on the table would give the board the power to award bonuses to IRS executives who meet or exceed performance goals. At a recent Senate Finance Committee hearing that fielded IRS reform ideas from the private sector, the National Association of Enrolled Agents proposed giving the newly rebranded IRS Management Board, pending a bill from Sens. Ben Cardin (D-Md.) and Rob Portman (R-Ohio), the power to award taxpayer services. In an interview with Federal News Radio, Robert Kerr, the executive vice president of NAEA and a former investigator for the Senate Finance Committee, shed more light on how the bonuses would help the IRS meets its taxpayer services goals.

“Some tried-and-true management theory will tell you that we need to set clear goals and we need to reward the achievement of those goals. And so if you have an agency that’s, in fact, all rowing in the same direction, there’s a reward for doing so,” Kerr said. Under this proposal, the IRS Management Board would serve as an independent third party that would determine which agency officials deserve raises. “This is something that is granted outside of the typical review that’s within the agency, so that there’s an impartiality to it — that someone else is going to make the judgment call on whether folks have made the goal, and what reward they deserve,” Kerr said. Following the passage of last year’s tax reform law, lawmakers on both parties have recognized the IRS needs more resources to meet its mission. Since FY 2010, the IRS has had its budget reduced by 20 percent, when adjusted for inflation. For some Republican members of Congress, the IRS Management Board might also help guarantee that an increased agency budget gets spending appropriately.

Versi IRS 6.1.2 ini sudah fix bug, unlimited, dan lebih stabil, s ystem hard cluster. Saat ini operator menerapkan hard cluster dimana chip operator hanya boleh mengisi pulsa dimana nomor tujuan harus dalam 1 daerah dealer.

“IRS is the one federal agency that touches most Americans, and I think Congress wants some assurance that the agency is, in fact, performing well. I also think that it’s a great balance when it comes to providing with funds. There’s been a lot of talk for many years that we’re not funding the agency appropriately.

I think there’s been resistance on the Hill because there’s a trust deficit as to whether IRS is able to manage more money well,” Kerr said. “So if we have a management board in place, with the right people on it, then it can assure Congress that IRS is, in fact, executing to its plan and executing well.” In recent years, the IRS has been adjusting its workforce through attrition. Since 2010, the agency has lost about 17,000 employees. “It’s not that the agency is controlling its workforce. The workforce is controlling the workforce, and I think that that makes it even more challenging for the service to perform as it would like,” Kerr said. In February, acting IRS Commissioner David Kautter called on lawmakers to give the agency critical pay authority for hard-to-fill information technology jobs. More recently, Charles Rettig, President Donald Trump’s permanent pick for the role, also came out in favor of critical pay authority.

The IRS has only made about 40 hires under its critical pay authority, and traditionally those hires only stay for a few years at a time. “I think that the agency was reluctant to staff all 40 [positions], that the optics on it wouldn’t be good if IRS had used all the slots, it would’ve suffered the abuse of ‘Oh, they’re out of control. They’re spending money hand-over-fist.’ And the alternative is not staffing them all, and you get criticized for not staffing them all,” Kerr said. More importantly, with the critical pay authority comes streamlined hiring authority, and allows private-sector executives to largely bypass the lengthy USAJobs process.

Computer auto shut-down signal can be sent in case of either input power failure or battery capacity reaching a defined value (definable in UPSilon 2000) and will be applied to all the computers with the software installed on them.

Computer auto shut-down signal can be sent in case of either input power failure or battery capacity reaching a defined value (definable in UPSilon 2000) and will be applied to all the computers with the software installed on them.

“People apply, and it takes weeks and weeks, and months and months to fill a slot. But this person doesn’t want to wait weeks and weeks and months and months to do this, to go through the hiring authority as it is currently lined up,” Kerr said. “At some point, you are having folks who are taking such significant pay cuts — private-sector folks making seven figures. You’re coming back and giving back to the country, doing good, and you’re going to end up just earning pin money, regardless of how it goes. But what we can’t do is spend a ton of time trying to bring them onboard.” “I think that there’s always a risk of taking a one-size-fits-all approach. The agency seems to be rather aggressively pushing a digital strategy, which I can understand because it’s a lower-cost approach for IRS.